🚀 9 APRIL BTC Trading 2025 – Bitcoin Price Analysis, Support/Resistance Zones & Trade Setups

As we move through the second week of April 2025, Bitcoin (BTC/USDT) continues to show signs of volatility and active trader participation. The hourly chart reveals key market movements, highlighting a recent recovery attempt following a significant dip. Traders and investors alike are eagerly observing the charts for potential setups that can deliver high risk-reward trades. In this blog, we’ll break down the BTC price action for 9 APRIL BTC Trading 2025, identify crucial support and resistance levels, and present two high-probability trade setups (1 buying opportunity and 1 selling opportunity).

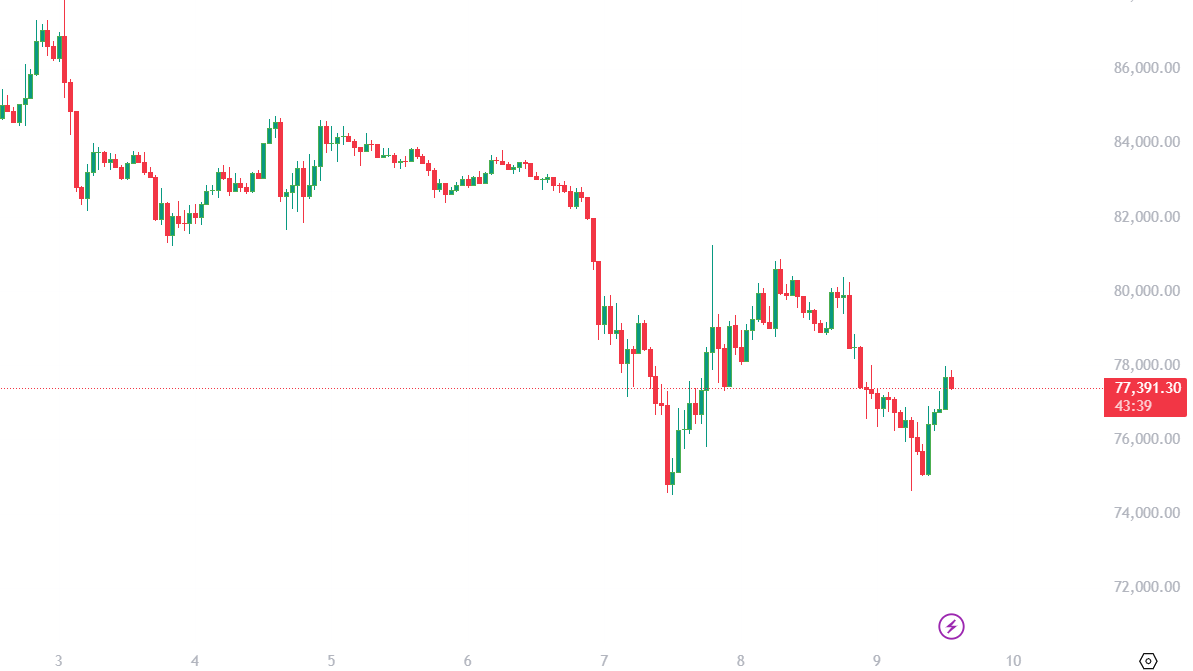

🧠 BTC Price Action Overview – What the Chart Shows

The 1-hour BTC/USDT chart from Binance indicates a sharp sell-off around April 6–7, which drove the price down to nearly $75,000. However, since then, we’ve seen a decent recovery, with BTC forming a short-term higher low and pushing back above $77,000 at the time of writing.

Here are the technical highlights:

- Sharp decline from the $83,000–$84,000 zone.

- A bullish engulfing candle on April 8th near the $75,000 mark suggests buying interest.

- The market is now consolidating between $76,000 and $78,000.

This context helps us identify key levels and trading opportunities for 9 APRIL BTC Trading 2025.

🔍 Key Support and Resistance Zones

Identifying support and resistance is crucial for traders to set clean entries, exits, and stop-losses. Based on the current price action, here are the critical zones:

✅ Support Zones:

- $75,000 – $75,500: Recent bounce zone; price respected this as support on April 8.

- $72,500 – $73,000: Strong psychological and technical support; previous bounce zone from April 3.

🚫 Resistance Zones:

- $78,500 – $79,000: Immediate resistance; price failed to hold above this after the bounce.

- $81,500 – $82,500: Major resistance; previous consolidation before the major drop.

These levels form the base of our strategy for 9 APRIL BTC Trading 2025.

📈 BUY TRADE IDEA – Long from Support Zone

🔹 Setup: Reversal from Key Support with Bullish Confirmation

BTC found strong support at $75,000 and bounced with bullish momentum. If price retests and forms a bullish candle near this zone, it provides a great buying opportunity.

- Entry: $75,500 (on bullish retest)

- Stop-Loss: $74,000 (below structure)

- Target: $79,500

- Risk-Reward Ratio: 1:3

🧠 Reasoning:

- Price bounced from a demand zone ($75K).

- Bullish engulfing pattern formed near the support.

- Trendline break on the short term suggests strength.

- RSI on LTFs like 15min/1h was oversold earlier and is now neutral, supporting upward movement.

⚠️ Confirmation Required:

Wait for a bullish candle near $75.5K for entry. No entry on sharp red candles—confirmation is key for 9 APRIL BTC Trading 2025 longs.

📉 SELL TRADE IDEA – Short from Resistance Zone

🔹 Setup: Lower High Formation & Resistance Rejection

If BTC pushes toward the $78,800–$79,000 resistance zone and rejects it with bearish candles (like shooting star or engulfing), we may see another leg down.

- Entry: $78,800

- Stop-Loss: $80,000 (above resistance)

- Target: $75,800

- Risk-Reward Ratio: 1:3

🧠 Reasoning:

- Previous price rejection at this zone.

- It’s a former support now acting as resistance (S/R flip).

- Momentum may fade near resistance if volume drops.

- Bearish divergence possible on short TF indicators like MACD.

⚠️ Ideal Entry Signal:

Look for bearish candles or rejection wicks near $78,800 zone before shorting. No blind entries—price action is king.

🧠 Tips for 9 APRIL BTC Trading 2025

- Use Alerts: Set TradingView alerts around key zones like $75.5K and $78.8K to avoid missing out.

- Manage Risk: Never risk more than 1-2% of your capital per trade.

- Watch USDT Dominance: A rise in USDT dominance can signal a BTC pullback.

- Check Volume: Confirm trades with rising volume in your direction—low volume moves can be fakeouts.

🌍 Global Market Sentiment

As of 9 APRIL BTC Trading 2025, global crypto sentiment is mixed:

- BTC dominance is slightly rising.

- Altcoins are consolidating, suggesting capital is flowing back into BTC.

- US inflation news expected midweek could influence Bitcoin’s volatility, so stay tuned.

📌 Conclusion – 9 APRIL BTC Trading 2025 Summary

Bitcoin remains a high-potential asset with tradable volatility. Based on the 1H chart for 9 APRIL BTC Trading 2025, we see two promising setups—a long from the $75,500 zone and a short near $78,800. Support and resistance zones have been respected well historically, offering reliable entry/exit points.

Whether you’re trading breakouts or retests, the key lies in discipline, risk management, and confirmation.

💼 Final Trade Recap – 9 APRIL BTC Trading 2025

| Trade Type | Entry | Stop Loss | Target | R:R Ratio |

|---|---|---|---|---|

| ✅ Buy | $75,500 | $74,000 | $79,500 | 1:3 |

| ❌ Sell | $78,800 | $80,000 | $75,800 | 1:3 |

What is the current trend for Bitcoin on 9 APRIL BTC Trading 2025?

As of 9 APRIL BTC Trading 2025, Bitcoin is showing a short-term recovery after a recent dip. The price is forming a potential higher low near the $75,000 support zone, suggesting bullish momentum may continue if resistance at $78,800 is broken.

What are the key support and resistance zones for BTC on 9 APRIL BTC Trading 2025?

The major support zones for BTC are:

$75,000 – $75,500 (recent bounce area)

$72,500 – $73,000 (strong structural support)

Is it a good time to buy Bitcoin on 9 APRIL BTC Trading 2025?

Yes, a buy opportunity exists near $75,500 if the price retests this level and forms a bullish candle. This setup offers a strong risk-reward ratio of 1:3. However, traders should wait for confirmation before entering.

Should I short BTC near $79,000 today?

Shorting BTC near the $78,800 resistance zone is a valid idea if the price shows bearish rejection patterns like a shooting star or bearish engulfing candle. This is a high-probability trade setup for 9 APRIL BTC Trading 2025 with a target near $75,800.

What indicators should I use for BTC Trading on 9 April 2025?

RSI for overbought/oversold confirmation

Volume to confirm momentum

Price Action patterns (like engulfing or pin bars)

MACD for trend confirmation on higher timeframes