13 APRIL GOLD XAU Trading 2025: Chart Analysis & Trade Setups with 1:3 RR

Gold (XAUUSD) continues to exhibit strong bullish momentum, attracting the attention of traders across the globe. As of 13 April 2025, the market structure shows a clear breakout from consolidation and a steady push towards higher resistance levels. This blog provides a detailed breakdown of the gold price action, key support and resistance zones, and two trade setups with a 1:3 risk-to-reward (RR) ratio, helping you make informed trading decisions. 13 APRIL GOLD XAU Trading 2025

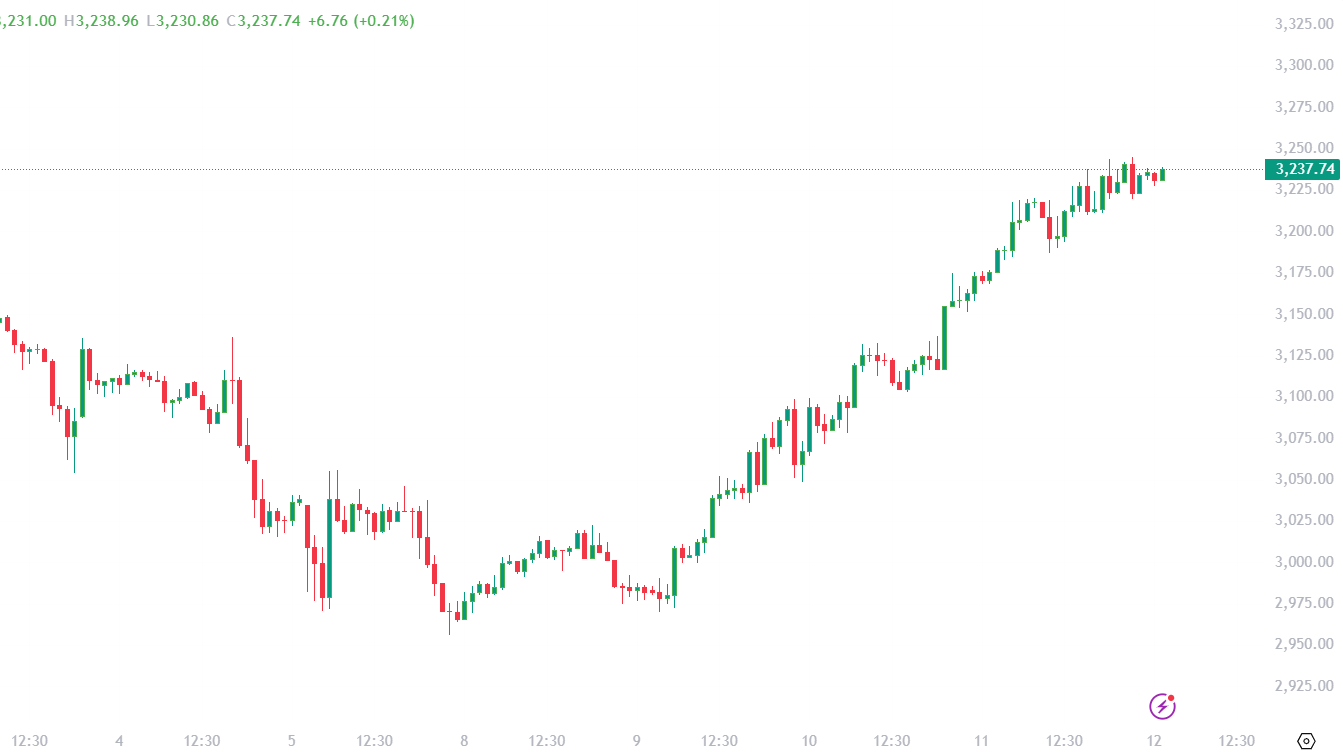

Let’s dive into the full analysis based on the 1-hour chart of XAUUSD. 13 APRIL GOLD XAU Trading 2025

📈 GOLD Price Overview – 13 APRIL 2025

- Current Price: $3,237.74

- Change: +1.96%

- Session High: $3,238.96

- Session Low: $3,230.86

- Trend: Strong bullish continuation after higher low confirmation

🔍 Chart Structure Breakdown

The uploaded 1H chart from TradingView highlights a strong bullish trend beginning around April 9th, after gold formed a double bottom near the $2,925–$2,950 support zone. Since then, we’ve seen consecutive bullish candles and very minimal pullbacks, suggesting buying pressure remains dominant. 13 APRIL GOLD XAU Trading 2025

Key Observations: 13 APRIL GOLD XAU Trading 2025

- Double Bottom Pattern – Strong reversal sign around $2,940–$2,950.

- Break of Structure – Price broke previous swing highs near $3,075, initiating a bullish trend.

- Trend Continuation – Higher highs and higher lows clearly formed.

- No Major Pullback Yet – RSI and price action hint at potential short-term exhaustion.

🧱 Support and Resistance Levels

Identifying strong price zones is key to successful entries and exits. Here are the current significant levels:

| Type | Price Level (USD) | Importance |

|---|---|---|

| Resistance | $3,250 – $3,260 | Intraday top / Possible reversal zone |

| Resistance | $3,300 | Psychological level |

| Support | $3,175 – $3,180 | Recent minor pullback base |

| Support | $3,050 – $3,060 | Previous consolidation breakout |

| Support | $2,950 | Strong double bottom zone |

📊 Trade Idea #1: Short (SELL) from Resistance Zone

Reason: Price is reaching the upper resistance zone around $3,250, where previous rally exhaustion and intraday highs have formed. This could attract sellers looking to catch a retracement. 13 APRIL GOLD XAU Trading 2025

📌 Trade Setup:

- Entry: $3,250

- Stop Loss: $3,275 (25 points risk)

- Target: $3,175 (75 points reward)

- Risk-Reward Ratio: 1:3

📉 Strategy Explanation:

- Look for a bearish engulfing candle or rejection wick at the $3,250–$3,260 zone.

- RSI divergence on lower timeframes (5M/15M) may confirm exhaustion.

- If price shows weak momentum near the top and fails to break above $3,260, this becomes a strong intraday short opportunity. 13 APRIL GOLD XAU Trading 2025

📊 Trade Idea #2: Long (BUY) on Pullback to Support

Reason: If gold retraces, the first key support is around $3,175, which was a previous breakout level. A bounce from this area can provide a clean bullish continuation setup.

📌 Trade Setup:

- Entry: $3,175

- Stop Loss: $3,150 (25 points risk)

- Target: $3,250 (75 points reward)

- Risk-Reward Ratio: 1:3

📈 Strategy Explanation:

- Wait for price to pull back to the $3,175–$3,180 area.

- Look for bullish reversal candlesticks or bullish engulfing on 15M/30M charts.

- Monitor volume—rising volume at support increases confidence in the bounce.

⚠️ Risk Management Tips

- Never risk more than 1–2% of your capital per trade.

- Always stick to your Stop Loss; gold is volatile and can move swiftly.

- Use trailing stops if the trade goes in your favor.

- Consider news impacts—gold reacts strongly to macroeconomic updates, inflation data, and geopolitical events.

🔮 Market Sentiment and Outlook

The gold market has been rallying due to a mix of global uncertainties, inflation hedge behavior, and technical breakouts. Based on current momentum and breakout patterns:

- Short-Term Sentiment: Bullish with minor corrective risks.

- Medium-Term Target: $3,300+ if support holds and bullish continuation confirms.

- Bearish Trigger: A strong break below $3,150 may lead to a deeper pullback to $3,050 or even $2,950.

📅 Weekly Outlook for Gold (XAU) – 14 to 19 April 2025

- Monday: Watch for initial reaction at $3,250 zone.

- Tuesday-Wednesday: If a pullback occurs, expect accumulation near $3,175–$3,180.

- Thursday-Friday: Bullish continuation possible if price holds support.

💡 Key Takeaways

- The 13 APRIL GOLD XAU chart shows clear bullish structure with a possible pullback due.

- Trade #1: Short at resistance ($3,250), Target ($3,175), RR 1:3.

- Trade #2: Buy on dip ($3,175), Target ($3,250), RR 1:3.

- Always confirm trades with price action and volume indicators.

- Be patient – let price come to your levels.

What is the current trend in Gold (XAUUSD) as of 13 April 2025?

Answer: As of 13 April 2025, gold (XAUUSD) is in a strong bullish uptrend, trading around $3,237.74. Price has broken multiple resistance levels and continues to make higher highs and higher lows on the 1-hour chart.

Is it a good time to buy gold on 13 April 2025?

Answer: A buy opportunity may arise if gold retraces to the support zone at $3,175, where previous resistance turned into support. Look for confirmation through bullish candlestick patterns or volume spikes before entering a long position.

What is the resistance level for gold on 13 April?

Answer: The key resistance zone for gold is between $3,250–$3,260, which aligns with the recent price top. A rejection from this zone could lead to a short-term pullback.

What is the best gold trading strategy today?

Answer: A great gold trading strategy for 13 April 2025 involves waiting for price action at key levels and trading with a 1:3 risk-reward ratio. Sell at resistance and buy at support, as per the technical setups provided.

What are the two best trade setups in gold today?

SELL Trade: Entry at $3,250, SL $3,275, TP $3,175 (1:3 RR)

BUY Trade: Entry at $3,175, SL $3,150, TP $3,250 (1:3 RR)

These are based on support/resistance zones visible on the 1H chart.